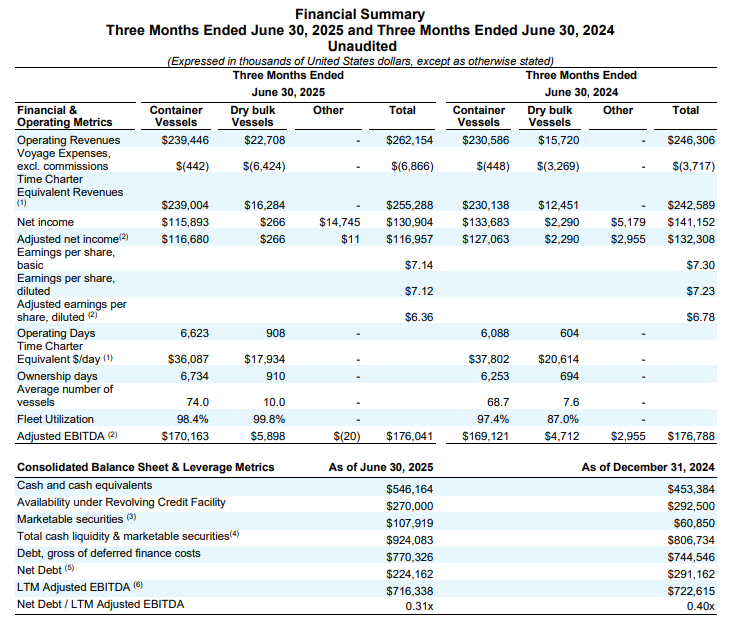

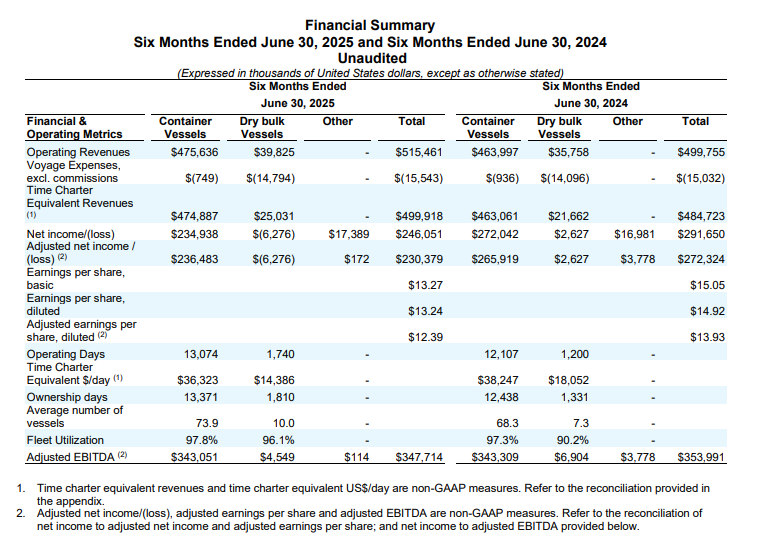

Danaos Corporation, one of the world’s largest independent owners of container vessels and drybulk vessels, reported unaudited results for the period ended June 30, 2025.

For management purposes, the Company is organized based on operating revenues generated from container vessels and dry-bulk vessels and has two reporting segments: (1) a container vessels segment and (2) a dry-bulk vessels segment. The Company measures segment performance based on net income. Items included in the applicable segment’s net income are directly allocated to the extent that the items are directly or indirectly attributable to the segments. With regards to the items that are allocated by indirect calculations, their allocation is commensurate to the utilization of key resources. The Other column includes components that are not allocated to any of the Company’s reportable segments and includes investments in an affiliate accounted for using the equity method of accounting and investments in marketable securities.

Highlights for the Second Quarter and Half Year Results Ended June 30, 2025:

- In June 2025, we added one 6,014 TEU newbuilding containership to our orderbook, which has expected delivery in 2027. We took delivery of 6 newbuilding containerships in 2024 and 1 in January 2025.

- Our remaining orderbook currently consists of 16 newbuilding containership vessels with an aggregate capacity of 134,234 TEU with expected deliveries of one vessel in 2025, three vessels in 2026, ten vessels in 2027 and two vessels in 2028. All the vessels in our orderbook are designed with the latest eco characteristics, will be methanol fuel ready, fitted with open loop scrubbers (except for two 6,014 TEU vessels) and Alternative Maritime Power (AMP) units and will be built in accordance with the latest requirements of the International Maritime Organization (IMO) in relation to Tier III emission standards and Energy Efficiency Design Index (EEDI) Phase III.

- We have secured multi-year charter arrangements for all of our 16 newbuilding vessels orderbook, with an average charter duration of approximately 5.2 years weighted by aggregate contracted charter hire.

- Since the date of the previous earnings release, we added approximately $113 million to our contracted revenue backlog through a combination of a new charter for our recent containership newbuilding vessel and charter extensions for three of our existing container vessels.

- As a result, total contracted cash operating revenues, on the basis of concluded charter contracts through the date of this release, currently stand at $3.6 billion, including newbuildings. The remaining average contracted charter duration for our containership fleet is 3.8 years, weighted by aggregate contracted charter hire.

- Contracted operating days charter coverage for our container vessel fleet is currently 99% for 2025 and 88% for 2026. This includes newbuildings based on their scheduled delivery dates.

- As of the date of this release, Danaos has repurchased a total of 2,937,158 shares of its common stock in the open market for $205.7 million under its recently upsized $300 million authorized share repurchase program that was originally introduced in June 2022 and was upsized twice in $100 million increments, in November 2023 and in April 2025.

- Danaos has declared a dividend of $0.85 per share of common stock for the Second Quarter of 2025. The dividend is payable on August 28, 2025, to stockholders of record as of August 19, 2025.

Danaos’ CEO Dr. John Coustas commented:

“As we move through the second half of the year, some uncertainties around global trade are beginning to subside. In particular, there is increasing clarity about tariffs, many of which have been or are being finalized at much lower rates than feared. While tariffs on imports to the U.S. will be much higher than historic averages, the U.S. economy is stable, and the American consumer keeps purchasing foreign goods. As inventories normalize, we anticipate a gradual improvement in trade flows.

Geopolitically, there have been no major shifts, with the conflicts in Ukraine and Gaza ongoing. The absence of further escalation is somewhat reassuring, though the potential for volatility remains elevated. We continue to monitor developments closely, but we have not seen any new disruptions to global shipping routes in the past quarter.

Against this backdrop, we are maintaining our disciplined approach to capital allocation. We are not broadly participating in the current wave of speculative ordering, particularly in the feeder segment, where pricing appears disconnected from long-term fundamentals, and are only pursuing investments that meet our return criteria. In the second quarter, we added one additional 6,000 TEU vessel to our orderbook at a shipyard with which we have an existing relationship. Importantly, this vessel has already been fixed on a five year charter to a long standing client, locking in visibility and attractive returns.

Our chartering strategy continues to deliver results. We added approximately $113 million to our contracted revenue backlog since the previous earnings release, and our $3.6 billion total contracted revenue base provides meaningful insulation from short-term market fluctuations. Our contracted charter coverage stands at 99% for 2025 and 88% for 2026, including newbuildings scheduled for delivery during this period.

On the dry bulk side, we saw some seasonal firming in the market, but broader weakness persists, largely due to deflationary conditions in China. While we continue to evaluate opportunities in the sector, asset values for modern tonnage remain elevated, and we are in no rush to commit capital in an uncertain macroeconomic environment.

From a financial perspective, we remain in an enviable position. With minimal leverage and a growing base of contracted earnings, we have the luxury of patience. Our strong balance sheet and cash generation capacity provide ample firepower to support our strategic priorities and position Danaos for long-term success. We continue to focus on disciplined execution, operational excellence, and value creation for our shareholders”.